A recent report from Findex/ALPMA found that stabilising cash flow was a major focus for law firms throughout 2021. Firms responded early with a focus on debt collection and rigorously improved processes and procedures. Other findings in 2021 included:

- 40% of fees billed were in debtors for more than 30 days, with 28% of fees remaining uncollected for more than 90 days.

- The average debtor days measured across all participating firms was 60 days.

- Outstanding tax liabilities are typically a signal of cashflow difficulties. Fortunately, 72% of firms indicated that their tax bills were manageable, and only 2% of surveyed firms had difficulty paying their outstanding tax liabilities.

In March, Ben Deverson conducted a webinar with FilePro, to explain Lawganised 5 Golden Rules for improving cash flow to achieve the following results. These results represent a significant difference to what was experienced by survey participants.

Ben’s session was well attended with positive feedback. A recording is now available to FilePro clients through our Online Learning Hub.

In short, there are a number of factors that work together to ensure firms collect the value of their work as soon as possible into their General Bank account. Improvement in processes and procedures often rely on functionality within a firm’s practice management system.

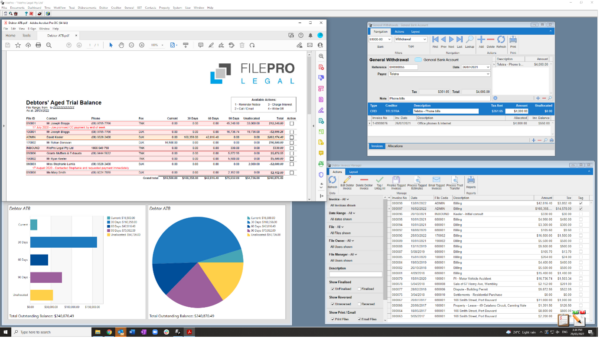

Are you using the following features within FilePro to improve your firm’s cash flow:

- Clear and concise invoice layout with multiple payment options – if you haven’t checked what can be done recently, worth getting in touch

- Internal reporting – Debtors, Aged WIP, Dashboards, custom reports and dashboard tiles, File Owner reports assist with debt collection

- External reporting – Reminder notices, interest calculations, delivery of Bills – bulk emailing invoices

- Procedural – setting practical debtor intervals (i.e. 14/30 days), efficient trust transfers, tracking ‘debtor status’ for each matter

- Timesheet warnings – staff can be notified when matters are close to cost agreement, debtors older than XX days

- Banking integration – find out what options are available, i.e. automated entry of client payments, interest on controlled money accounts etc.

Any FilePro client wanting to know more about these features or how to access the Online Learning Hub, please contact our support team on 1800 049 790.

If you’re not a FilePro client but would like to see these features and more in action, contact us on 1300 65 33 80.