If managing your firm’s tax or tech gives you headaches, don’t worry, you’re not alone.

Bentleys recently published the second edition of The Voice of Australian Business Survey, a study of 328 small to mid-sized enterprises (SME) in Australia. The research identified two pain points for SMEs – the management of taxation affairs and adaptation to rapid technological change.

As a partner or practice manager with limited time and resources, you’re probably fighting to find balance between two types of task – your urgent day-to-day duties, and more long-term strategic thinking.

For example, you need to make sure all expenses are recorded correctly, but also need to evaluate overall expenditures. Or you need to make sure timesheets are filled out, but also need to update your time capture software and organise training.

By analysing the results of The Voice of Australian Business Survey, we’ve identified some broad strategies you could consider to help manage change in taxation and technology.

Taxation

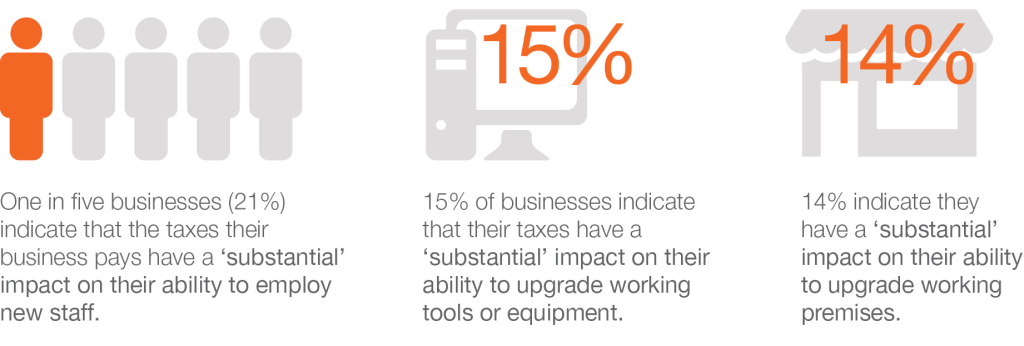

It goes without saying that the Australian tax system is complex. So it’s no surprise that the survey data revealed SMEs have difficulty managing their tax.

While understanding the entire tax system and how to comply is often challenging for many legal practices and SMEs, it is important to understand how taxes may impact your day-to-day operations, including cash flow and payroll.

There are measures that many professional legal practices can put in place to help reduce the overall taxation compliance burden:

-

Ensure your financial and taxation affairs are structured appropriately, e.g. consider whether a partnership or corporate structure would better suit your needs

-

Register for SuperStream to make paying super contributions for your employees simpler and more efficient (this is mandatory for employers with 20 or more employees from 1 July 2015)

-

Keep up to date with your Taxation Office compliance and payment obligations by working closely with your advisor to get your compliance work done early. This will give you more time to prepare for any possible tax payments

Bentleys has assisted many legal practices with understanding the complexity of their structures and has delivered advice on the how to change from a partnership to a corporate structure.

Our team have attended management meetings on behalf of our practice clients to help demystify tax and other compliance obligations, as well as assist with ongoing management accounting, debt structuring and cash flow forecasting for the practice.

Technology

In the last 10 years the rate of technological change has increased substantially – you’ll be shocked to learn that the iPhone will be celebrating only its 8th birthday this month.

Increased performance and capabilities, coupled with decreasing costs, mean technology is increasingly accessible for SMEs. This is having a profound affect on a number of professions and industries – including law.

Despite this radical advancement in technology, data from Bentleys’ The Voice of Australian Business Survey shows that SMEs are still facing challenges in its adoption, particularly with cloud-based solutions.

-

The main challenges facing Australian businesses in relation to technology are data security (30% of businesses), insufficient funding (30% of businesses) and lack of staff experience (29% of businesses)

-

Interestingly, 37% of small businesses and 30% of medium businesses identified a ‘lack of staff expertise’ as the biggest challenge facing them in relation to technology

-

Overall the most common concerns about cloud services were the security of data storage (40% of businesses), the safety of data storage (38% of businesses) and data confidentiality (37% of businesses).

To keep pace with technological change legal practices could consider:

-

Investing in training for your existing staff – the short term costs associated with doing so can deliver long term benefits to your business in becoming more efficient

-

Engaging staff who are “tech savvy” – Gen Y (those aged 21-34) are digital natives and can often be your best resource in helping to navigate new technology

-

That technology does not need to be expensive – there are thousands of apps or server hosting providers that can help your business become more efficient

-

Embracing and investing in cloud solutions – cloud-based solutions can include a hosted-server solution, giving you 24/7 access to information while outsourcing the cost of maintaining your own servers, backups and system upgrades. However, what ever solution you adopt, ensure you use a reputable provider or proven and independent server hosting solution.

New technology is no longer the sole domain of large enterprises. Technological change brings small-to-mid-sized practices a tremendous opportunity to level the playing field and provide more cost-effective services – ultimately improving growth.

The above strategies only scratch the surface of how to best manage such change. If you’re not comfortable with technology or taxation, you should, as a starting point, consult someone you trust to assist you in finding the right solutions, and go from there.

About Bentleys

Bentleys is a national association of independent accounting firms in Australia. They’ve assisted many legal practices navigate the complex ecosystems of taxation and technology.

Bentleys is a national association of independent accounting firms in Australia. They’ve assisted many legal practices navigate the complex ecosystems of taxation and technology.

As a mid-tier accounting, audit and advisory firm, Bentleys gives you access to over 60 Directors and 400 experienced advisors across 10 office locations in all major Australian capital cities, New Zealand and some regional areas. To learn more visit Bentleys

This is not advice. You should not act solely on the basis of the material contained in this article. Items herein are general comments only and do not constitute or convey advice per se. Also changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide and should be regarded as confidential and not made available to any person without prior approval. This article is written by Bentleys NSW Pty Ltd. A member of Bentleys, an association of independent accounting firms in Australia. The member firms of the Bentleys association are affiliated only and not in partnership.