Your bank reconciliation is your ultimate source of truth – matching your movement of money in the real world to your accounting system.

If we work backwards from there, it makes sense to have accounting entries sitting alongside your matter management system so that you can trust that your staff are not missing anything and that your matter balances and general ledger accounts are 100% accurate synchronised.

Here are eight benefits of having a single source of (financial) truth and why it makes sense to have your matter management in the same software application as your accounting system.

1. Debtors and Accounts Receivable

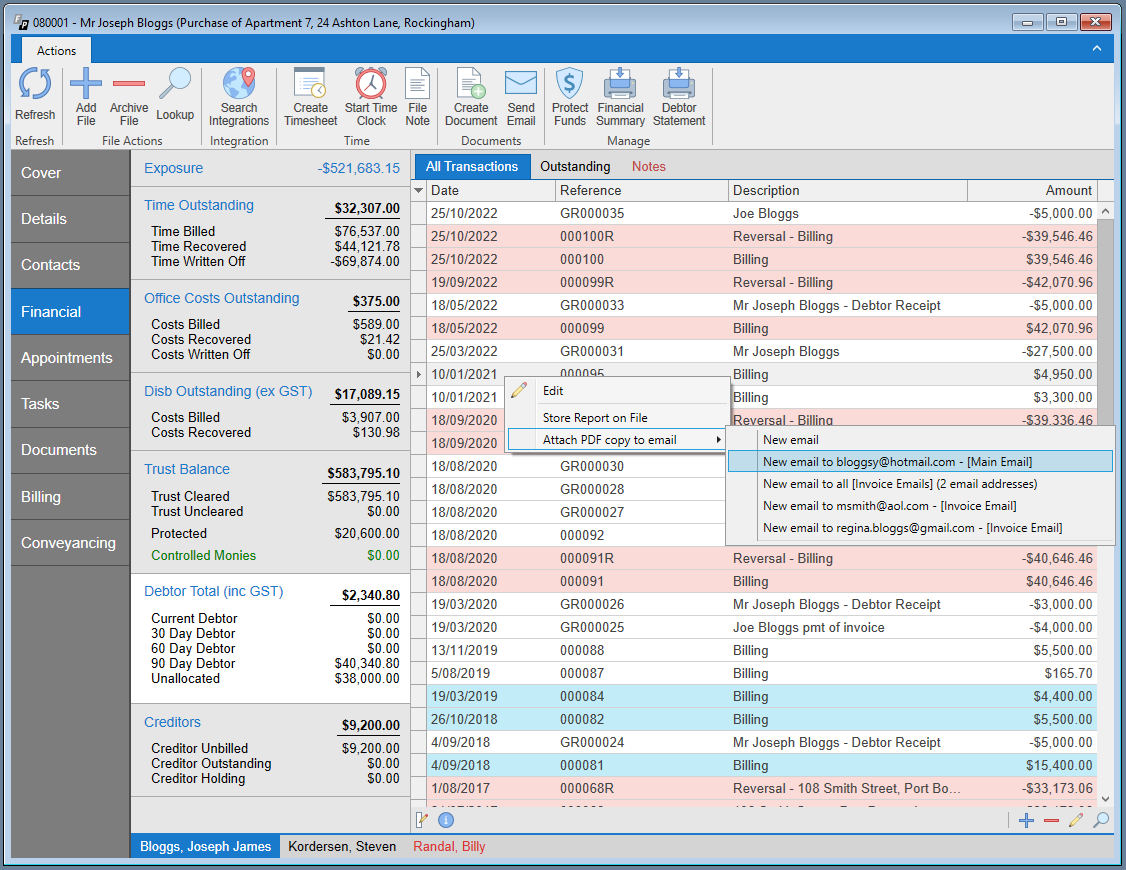

To reconcile the bank account, all receipts into your general account/s will need to have been entered. If you do this in the same place that your matters reside, you can trust that client ledgers, aged reports, reminders and other debtor management tools are accurate and that your staff will not need to ask the accounts team about who owes what.

Sometimes firms choose to still enter incoming client payments to the matter management system for debtor management, even if the accounts are managed separately. However, this creates double-handling and without the bank reconciliation process, it is difficult to guarantee that all receipts have been entered perfectly.

2. Client Disbursements

Many payments from your general account will be made on behalf of your clients. Once again, for your bank accounts to reconcile, these payments will need to have been entered accurately.

If you are entering disbursement payments into an external accounting system and away from your matters, you will not be posting them to your matter ledgers and instead will be required to create separate records in your matter management system for billing purposes. This creates more double-handling, room for error and the requirement for manual checks & balances between separate software applications.

3. Creditors and Accounts Payable

If you choose to maintain creditors in your accounting system for your accounts payable, many of the invoices you receive from suppliers will relate to clients. The same applies as with disbursements above; having your creditor management and matter management in separate software applications means double-handling, manual checks & balances and the potential for disbursements to be missed when you invoice your clients.

Some automated disbursements, such as online search fees, might be automatically linked to matters and entered as creditor invoices in your practice management software (or PMS). This benefit can become redundant or difficult to reconcile if your creditor management does not sit alongside your matters.

4. Compliant Trust Accounting

Typically, off-the-shelf accounting systems will not cater for trust account management that complies with your local Legal Practice Boards, Law Societies etc. This means that you will often need to run your trust account/s and controlled money account/s through your practice management software, where your matter management is located, regardless of where your general accounting lives.

If your general accounts are managed alongside your trust accounts, then transfers between the two will inevitably become more streamlined and compliant. PMS with strong trust and general accounting will have automated tools to flag funds for transfer when invoicing, protect money that should not be used elsewhere and then allow for bulk, automated transfers from trust to general with minimal key-strokes.

Can you (amongst other things) readily produce reports to confidently highlight any funds you may be holding, where a debtor balance also exists or where a transfer of funds is possible?

5. Reporting and Dashboards

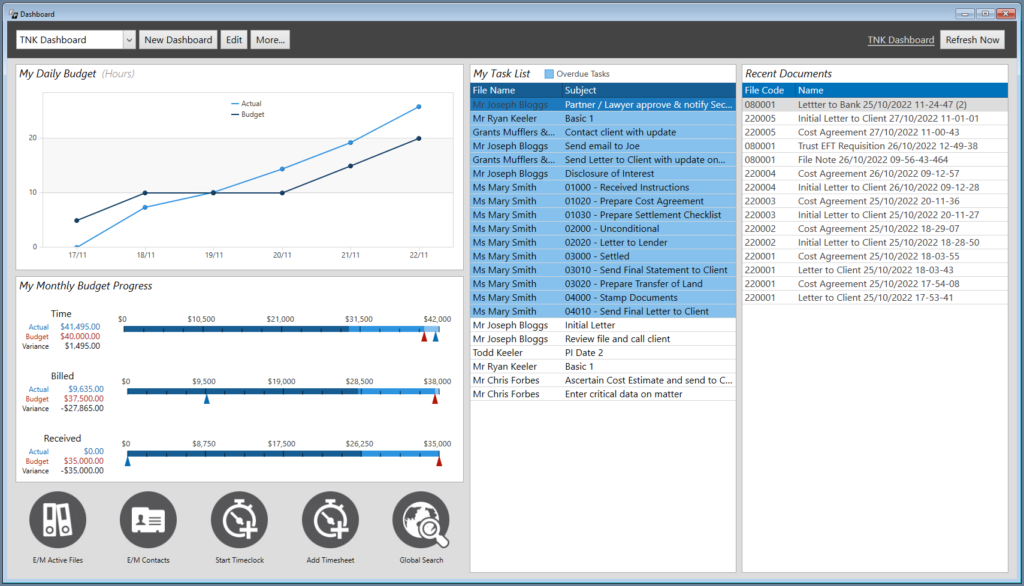

It stands to reason that if both accounting and matter management data live within the same database:

- producing reports that combine and compare information from both will be more straight-forward and not person dependent (as many standalone systems are).

- dashboard-style reporting and analysis is an adhoc option with real-time information constantly at-hand as information from matters, accounts, documents, tasks and so on are all sitting side-by-side. This becomes challenging (if not impossible) when you are using multiple software applications for the different parts of your business.

A PMS provider who you are comfortable to lean on should be willing to discuss custom reporting options for your firm. This means that if you have your team copying and pasting from one system to another, into Excel etc., what traditionally may take hours could be reduced to a few clicks.

6. Data, Integrations and Customisation

Housing your accounting tools within your PMS supports integrated software solutions and opportunities for customisation. Whilst some generic accounting platforms provide a suite of integrations, it is unlikely that you will be able to request changes to these, or that the vendor will consider introducing new integrations that are relevant to only one segment (eg legal profession) of their total client base.

Likewise, customisation of software applications to suit your firm and manipulation of your data is typically more within reach if you work closely with a specialised Legal PMS provider, rather than generic accounting software platforms.

7. Balancing Flexibility with Security

Using more of an ‘all-in-one’ system and granting your team the ability to see financial balances, ledgers etc. that relate to clients does not mean compromising security or exposing sensitive information.

You can have the best of both worlds by restricting access to certain functions and reports, limiting reports for individuals and teams, and so on. It is possible to make sure that your entire office can see a client’s work-in-progress, their debtor balance and how much they are holding in trust, without allowing them to edit an invoice, adjust trust transactions or see the firm’s profit & loss.

8. General ease of use

In most cases, Legal PMS is developed to be user-friendly and intuitive, meaning Legal professionals will be able to use the software with minimal training.

Generic accounting systems tend to be developed for the broader business community and whilst they may be the preferred tool for Accountants and contract Bookkeepers, they are not necessarily easy to pick up for someone who does not have an accounting degree or years of experience in accounts.

How do your current systems and processes compare and how to assess potential new providers?

You should find that a strong PMS, that incorporates matter management and accounting features, will use terminology that makes sense and offers a strong support team who can help law firm staff with any accounting and bookkeeping related queries, issues, regulations, guidelines and best practice.

Ask PMS providers how they manage onboarding of financial data such as bank reconciliations with unpresented items, trust opening balances, outstanding creditor invoices, general ledger balances via journal etc and whether they have experience helping their clients with complex financial scenarios like restructures. Ask for reference sites!

If you would like to discuss merging your matter management and accounting systems, leaning on your PMS provider for support or anything else in this article, please feel free to contact the FilePro team on 1300 65 33 80.