Cash flow is the lifeblood of any business. This is specifically relevant to legal practices where firms can often get into trouble with client engagement processes not designed to support efficient cash flow.

Yet cash flow is not about billing. It’s about the entire relationship with your client, ie from the minute they offer you instructions to the minute you get paid. Subtle changes in the way firm’s manage their cash flow can mean more revenue converting to cash into the firm’s bank account. It’s therefore important to differentiate cash from revenue results – cash is what firms use to grow, pay bills, reinvest in the business or pay dividends.

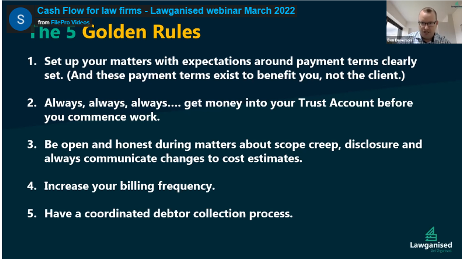

In a recent webinar conducted for FilePro, Ben Deverson, CEO of Lawganised, explained the 5 golden rules to improve cash flow whilst recognising that not all the rules may apply to all firms.

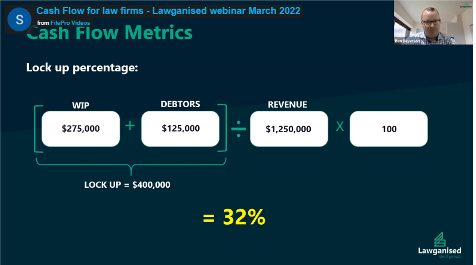

In this case, 32% of this firm’s revenue is sitting uncollected which represents 117 days. So, this firm would need approximately one third of their annual revenue as working capital (coming from an overdraft or funds from the firm’s owners) to keep this firm operating before cash is received from the work completed.

In this case, 32% of this firm’s revenue is sitting uncollected which represents 117 days. So, this firm would need approximately one third of their annual revenue as working capital (coming from an overdraft or funds from the firm’s owners) to keep this firm operating before cash is received from the work completed.

Using the above example for a firm generating $1.25m in annual revenue, the reduction in lockup by 73 days, represents $250,000 extra cash in the firm’s General Account.

Using the above example for a firm generating $1.25m in annual revenue, the reduction in lockup by 73 days, represents $250,000 extra cash in the firm’s General Account.

In this webinar, Ben explained in detail the Lawganised five Golden Rules to improve cash flow, how to implement them and then how to ensure you maintain a cash flow focused client engagement lifecycle. Cash flow is a culture, not a process.

Ben also demonstrated how subtle changes can make a significant impact on your firm, both positively and negatively. An interesting example given in relation to a mutual FilePro client involved automating a complex document, saving the firm 5 hours of work, and therefore generating a significant saving and therefore profit, regardless of whether the firm charges a fixed fee or by hourly rate.

To view the entire webinar, FilePro clients can access the recorded webinar from FilePro’s Online Learning Hub.

To explore your firm’s cash flow lock up in more detail, Lawganised offers a Cash Flow Lock up calculator on their website.

About the author

Ben Deverson is the Founder & Director of Lawganised and has had a 24-year executive career of which over half has been managing and leading professional services firms. For four years (2016-2019), Ben was the principal of a boutique law firm in Brisbane. Whilst not being a qualified lawyer, Ben is a management specialist. He has gained an intimate knowledge of the challenges that law firms face each day. Ben’s strengths include strategic planning, forecasting, cash flow management, process automation, performance metrics, leadership, and legal practice risk management. Ben has a passion for helping law firm principals maximise their resources so that they can have a new and positive outlook on their business lives and their lives.

In this webinar, Ben explained in detail the Lawganised five Golden Rules to improve cash flow, how to implement them and then how to ensure you maintain a cash flow focused client engagement lifecycle. Cash flow is a culture, not a process.

Ben also demonstrated how subtle changes can make a significant impact on your firm, both positively and negatively. An interesting example given in relation to a mutual FilePro client involved automating a complex document, saving the firm 5 hours of work, and therefore generating a significant saving and therefore profit, regardless of whether the firm charges a fixed fee or by hourly rate.

To view the entire webinar, FilePro clients can access the recorded webinar from FilePro’s Online Learning Hub.

To explore your firm’s cash flow lock up in more detail, Lawganised offers a Cash Flow Lock up calculator on their website.

About the author

Ben Deverson is the Founder & Director of Lawganised and has had a 24-year executive career of which over half has been managing and leading professional services firms. For four years (2016-2019), Ben was the principal of a boutique law firm in Brisbane. Whilst not being a qualified lawyer, Ben is a management specialist. He has gained an intimate knowledge of the challenges that law firms face each day. Ben’s strengths include strategic planning, forecasting, cash flow management, process automation, performance metrics, leadership, and legal practice risk management. Ben has a passion for helping law firm principals maximise their resources so that they can have a new and positive outlook on their business lives and their lives.

Why is cash flow management important?

Let’s start by understanding what and how to monitor 2 key cash flow metrics:- Work in Progress (WIP) in value and days; and

- Debtor value and days.

In this case, 32% of this firm’s revenue is sitting uncollected which represents 117 days. So, this firm would need approximately one third of their annual revenue as working capital (coming from an overdraft or funds from the firm’s owners) to keep this firm operating before cash is received from the work completed.

In this case, 32% of this firm’s revenue is sitting uncollected which represents 117 days. So, this firm would need approximately one third of their annual revenue as working capital (coming from an overdraft or funds from the firm’s owners) to keep this firm operating before cash is received from the work completed.

What lock up does Lawganised advocate?

Using the above example for a firm generating $1.25m in annual revenue, the reduction in lockup by 73 days, represents $250,000 extra cash in the firm’s General Account.

Using the above example for a firm generating $1.25m in annual revenue, the reduction in lockup by 73 days, represents $250,000 extra cash in the firm’s General Account.

So, what are the 5 golden rules for improving cash flow?

In this webinar, Ben explained in detail the Lawganised five Golden Rules to improve cash flow, how to implement them and then how to ensure you maintain a cash flow focused client engagement lifecycle. Cash flow is a culture, not a process.

Ben also demonstrated how subtle changes can make a significant impact on your firm, both positively and negatively. An interesting example given in relation to a mutual FilePro client involved automating a complex document, saving the firm 5 hours of work, and therefore generating a significant saving and therefore profit, regardless of whether the firm charges a fixed fee or by hourly rate.

To view the entire webinar, FilePro clients can access the recorded webinar from FilePro’s Online Learning Hub.

To explore your firm’s cash flow lock up in more detail, Lawganised offers a Cash Flow Lock up calculator on their website.

About the author

Ben Deverson is the Founder & Director of Lawganised and has had a 24-year executive career of which over half has been managing and leading professional services firms. For four years (2016-2019), Ben was the principal of a boutique law firm in Brisbane. Whilst not being a qualified lawyer, Ben is a management specialist. He has gained an intimate knowledge of the challenges that law firms face each day. Ben’s strengths include strategic planning, forecasting, cash flow management, process automation, performance metrics, leadership, and legal practice risk management. Ben has a passion for helping law firm principals maximise their resources so that they can have a new and positive outlook on their business lives and their lives.

In this webinar, Ben explained in detail the Lawganised five Golden Rules to improve cash flow, how to implement them and then how to ensure you maintain a cash flow focused client engagement lifecycle. Cash flow is a culture, not a process.

Ben also demonstrated how subtle changes can make a significant impact on your firm, both positively and negatively. An interesting example given in relation to a mutual FilePro client involved automating a complex document, saving the firm 5 hours of work, and therefore generating a significant saving and therefore profit, regardless of whether the firm charges a fixed fee or by hourly rate.

To view the entire webinar, FilePro clients can access the recorded webinar from FilePro’s Online Learning Hub.

To explore your firm’s cash flow lock up in more detail, Lawganised offers a Cash Flow Lock up calculator on their website.

About the author

Ben Deverson is the Founder & Director of Lawganised and has had a 24-year executive career of which over half has been managing and leading professional services firms. For four years (2016-2019), Ben was the principal of a boutique law firm in Brisbane. Whilst not being a qualified lawyer, Ben is a management specialist. He has gained an intimate knowledge of the challenges that law firms face each day. Ben’s strengths include strategic planning, forecasting, cash flow management, process automation, performance metrics, leadership, and legal practice risk management. Ben has a passion for helping law firm principals maximise their resources so that they can have a new and positive outlook on their business lives and their lives.