Minimising debtor days is a task that most firms continually work on and struggle with. Freeing up your cash flow and reducing the need for funding are fairly significant incentives, but other duties often take priority. And let’s face it, nobody enjoys chasing debtors.

This month we wanted to share how FilePro can reduce debtor days. Hopefully you can use these ideas to take the pressure of your own cash flow and accounts receivable department.

1. The billing process itself

If you’re frustrated with how long it takes to render invoices and get them out the door, you’re not alone. We regularly see firms processing their bills at the end of the month, only to have them sitting on desks three weeks later.

The most commonly used (and effective) billing cycle adopted in FilePro is:

- Produce File Balance reports for each fee earner to ascertain which files need to be billed

- Generate Unbilled Cost reports for these files and have file owners mark up the reports

- Open files, edit unbilled items and then produce automatic invoices

- Once invoices are sent, utilise Invoice Manager screen to finalise all invoices

Most firms already utilise this process, however you may not be aware that the Unbilled Cost report can be enhanced to make this process even easier. It can:

- Include information regarding previously billed costs

- Show tick boxes to highlight items that are to be written off

- Estimate the trust remaining after the invoice

- Have room to indicate a further amount of trust to request

You may also be interested in switching on ‘Estimate Invoices’, where all invoices start as an estimate and have no bearing on your financials or debtor ageing.

By applying some small changes to this process, you can greatly reduce the time and effort required during billing time. Ask the NRC about a billing health check if you would like to learn more.

2. The all-important invoice layout

How many times have you received an invoice and been confused by the amount of information hidden throughout complex pages, only to toss it aside? Various telcos spring to mind.

How your invoice looks has a significant impact on how quickly your clients will pay – making them clear and concise is key.

If you have several layouts for trust transfer, previous debt, itemisation or set cost invoices, you can limit the number of layouts by automating standard templates with the Report designer. While it cannot allow for every situation, often one layout with certain coding can allow for multiple scenarios.

There are many other amendments that can be applied to your invoice layout: requesting additional trust money, mentioning your preferred charity, or offering discount incentives. However, the key idea is still paramount – make your invoice clear and easy to understand.

If you would like further information regarding your options with FilePro invoice templates or would like to see some examples, we’re a phone call away.

3. Payment options

If your client is wading through a dozen invoices, chances are the account with a clear remittance offering credit card, BPAY, EFTPOS and cheque payment options will be addressed before less flexible alternatives.

Below is an examples of the remittance section used by the NRC. We are utilising Macquarie Bank’s DEFT functionality, which tracks client payments and automatically enters them in FilePro.

4. File owner assistance

When managing your debtors, spreading responsibility can help. By editing report layouts in FilePro, you can effectively share debtor duties and improve communication across your firm.

By editing the Debtor Aged Trial Balance report, you can create room to indicate what action is to be taken, with a legend showing the options at the top. We have added the clients phone numbers and have also included debtor history (when it exists) which is being stored at the file level using custom fields. This report can be generated by the file owner and distributed to the relevant fee earners.

Firms who take this approach experience greater involvement from file owners, considerably improving debtor management.

5. Reminders and interest

You can use FilePro to produce multiple levels of reminder, based on the age of the debt. Just like invoice templates, you can create more than one layout allowing for varying levels of severity.

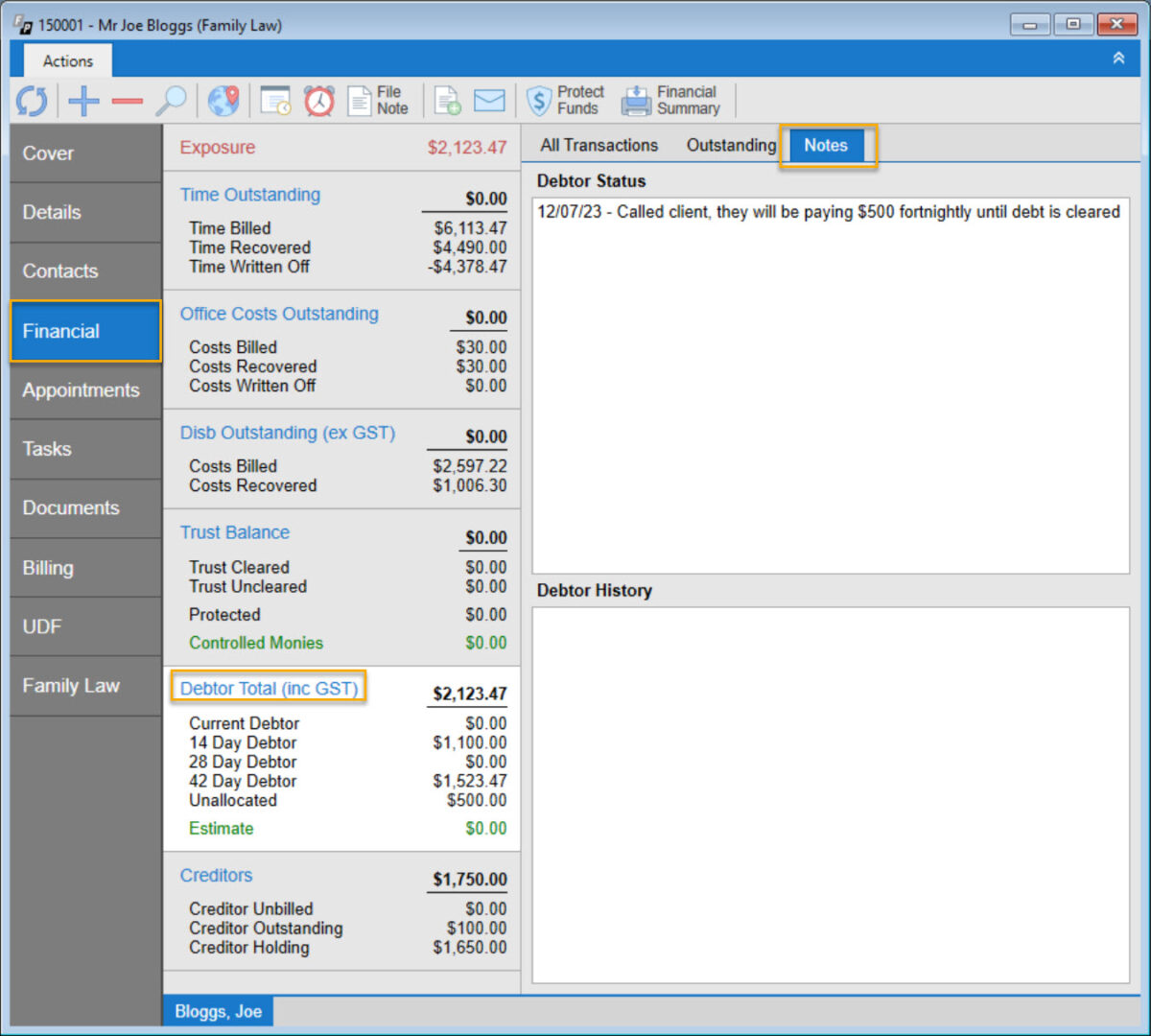

As mentioned previously, you can also track your history chasing debtors by using custom fields in the file screen. A popular method is to use the two text boxes in the ‘Calc’ tab of the file. The current status can then be transposed into your Debtor reports.

You can also mention on your invoice or cost agreement that interest will be charged on overdue accounts – the calculation module in FilePro is straightforward and easy to use.

If you would like further guidance on this or any of the other items in this month’s NRC best practice article, please get in touch.