The end of financial year is fast approaching and that probably means you have a very long list of tasks to attend to.

Thankfully, your firm can continue to function following the financial year-end without having to complete any specific processes. Your Profit and Loss will automatically start from zero balance on 1 July.

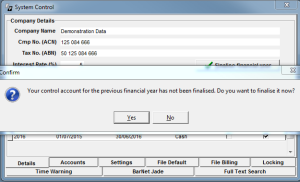

At some point you will need to go into your System Control and finalise the 2015 financial year. This will roll forward your balances and consolidate your 2015 Profit and Loss balance to the Retained Earnings account. In order to do this, navigate to System, then System Control. After the 1 July you’ll receive the following message.

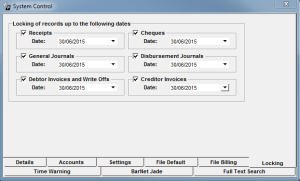

Finalising the financial year will not lock 2015 – you can still go back and view or edit entries prior to 1 July. However, at some point (once you’ve finished with 2015 and printed your reports for your accountant) you should go back to the System Control screen and turn Locking on for that period. This will assure that nothing can be changed.

As part of your general end-of-year processes, there are checks that you can also do within FilePro. It is best practice to check that your subsidiary ledgers: Disbursements, Debtors, Creditors, and Cashbooks, all equal the closing balance of the Control Accounts in the General Ledger.

In order to do this, you should run the following reports on 30 June 2015.

- Debtors Aged Trial Balance (Debtors>Reports)

- Creditors Aged Trial Balance (Creditors>Reports)

- Outstanding Disbursements (Disbursements>Reports)

- Bank Reconciliation Report (General>Reports)

- Trial Balance (General>Reports)

The total figures shown on each of the four reports listed should agree with the figures outlined on the Trial Balance.

If a discrepancy is noticed, please contact the National Resource Centre and we’ll help investigate any issues. You don’t need to wait until the end of financial year to perform these checks – they can form part of your monthly procedures.

End of Financial Year – Trust Accounts

The end of a trust year is very different to the end of the financial year. Each state will have specific dates and procedures, however one ruling does remain the same for all states.

A trust account statement is to be furnished as soon as practical after 30 June, unless the following have occurred:

- The account has been opened for a period of less than six months

- The balance of the account is zero and no transactions affecting the account have taken place within the previous 12 months

- A trust account statement has been furnished within the preceding 12 months and there have been no additional transactions since the date of generating that statement.

Please refer to the trust account legislation relevant to your state for further details.

Sending out your yearly trust statements is simple too. Just go to Yearly Statements from the Trust Report menu – if you don’t see this option, log into the system as a system administrator and you’ll be able to run the report.

Tips and Tricks

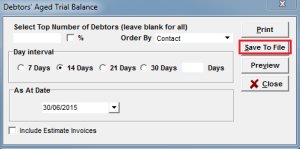

Saving Reports

You probably know that FilePro reports can be previewed or printed, but they can also be saved as a file. There are a few options to choose from – PDF and excel formats being the most popular.

This allows you to easily send data to your accountant at the end of financial year and also create specialised excel reports utilising the data within FilePro.

Simply click on Save to File when running a report.

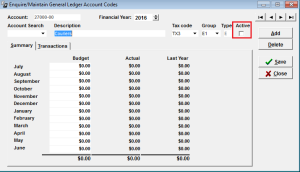

Inactive Account Codes

The end of financial year is the perfect time to clean up any unused account codes.

We often see account codes such as “Provision for Rounding – DO NOT USE”. Instead, you can simply deactivate account codes that are no longer used. These items will still be referenced in reports if they have data associated with them, however will no longer be available when entering new data.

To deactivate account codes navigate to the General menu> E/M General Ledger>E/M Account Codes. Select your Account code, then uncheck the box.

If you want to completely remove account codes from your system please contact the National Resource Centre to discuss further.